Humans aren’t very good at risk. Or rather they are good as long as the future looks a lot like the recent past. In economics, this way of looking toward the future is called “adaptive expectations“, where we change the way we look at the world only when an event comes along that jars with our original working hypothesis of how we thought things work.

For a time, the more sophisticated idea of “rational expectations” ruled the roost in economic circles (and in 1995 the economist Robert Lucas picked up a Nobel prize for his work on this idea). Lucas’ idea was that individuals discounted all known information (not just empirical evidence from the past) so accordingly their expectations over future economic variables should show no discernible bias. Partially on the back of this belief, Lucas made the following statement to the American Economic Association in 2003:

The central problem of depression-prevention has been solved, for all practical purposes, and has in fact been solved for many decades.

The statement contained two components of Lucas’ libertarian philosophy: 1) past recessions came about as a result of governments messing up and 2) private-sector actors act rationally and efficiently if left alone. And then along came the popping of countless irrational bubbles in 2009 and the subsequent Great Recession—out of which we are still struggling to emerge.

What has this got to do with the themes of this blog? Well, if we assume that the expectations of individuals are formed in an adaptive manner, then on the big questions of climate change and resource depletion, secular shifts and step changes will cause populations to consistently make bad decisions. People will cling to the past until their lives are turned upside down.

In other words, if Mark Twain was wrong, and history doesn’t repeat itself or rhyme, then we humans appear to be in trouble; we are preprogrammed to look for rhymes and find them even when they don’t exist. We all have our life narratives—the work we do, where we live, the lives we wish ourselves and our kids to lead—and we don’t like it when this narrative is questioned.

Confirmation bias is rife in this way of thinking. If a piece of information comes along that supports the narrative, it is emphasised; if it contradicts the narrative, it is discounted. Nonetheless, if a new piece of information hits with sufficient force, it won’t be completely ignored. Or alternatively, a little bit of discomfort if continuously felt will cause us to shift our position.

Climate change, being the wicked problem that it is, fulfils neither of these conditions. The hot years of 1998 and 2009 were just not hot enough to permanently shift the narrative. And the hot years are sufficiently infrequent to allow us to forget. Mother Nature hasn’t helped by putting the globe into a La Nina-dominated phase of the ENSO cycle, thus masking the upward trend in temperature over the last few years.

The statistician Tamino, in his excellent Open Mind blog, analyses this phenomenon in a recent post (with much of this work building on an article in Nature by Kosaka and Xie in Nature). In his words:

The influence is clear: a pronounced recent ENSO-induced cooling which has cancelled the continued global warming due to man-made CO2, leading to the “hiatus” in the increase of global temperature.

And he includes a chart that shows how much the ENSO cycle is currently subtracting from the overall warming trend:

Nonetheless, despite the fact we are living in a hiatus period of slow temperature rise, the maximum temperature records are still coming thick and fast. For a state of play, see here. My old home of Japan, for example, posted a new record of 41 degrees Celsius this summer, and new highs also came in Slovenia, Austria and Greenland. When the next strong El Nino rolls round, I expect this records page to explode. In the meantime, however, people are just bored with the unspectacular gradual saw-tooth warming path as encapsulated in Dr Roy Spencer satellite temperature anomaly chart:

This sawtooth is typical of a stochastic process with a trend. Climate change may punch you in the face one year, but it is highly unlikely to punch you in the face two years in a row. Accordingly, all those symptoms of climate change also have a tendency to fade in and out of consciousness year by year. So in 2012, we had an extraordinary collapse in Arctic sea ice extent. And this year?

Of course, the downward trajectory is still intact. The average for September 2013 looks like coming in at around 5 million square kilometres, which would put it slap bang on trend.

Actually, I think the media was already bored with sea ice extent. Coverage during the shocking collapse last year was patchy at best. Sea ice extent decline can be seen as the canary in the coal mine for climate change, but few actually care that the canary is dying. In 2012, the Financial Times and Wall Street Journal devoted far more space to polar shipping route and oil and gas drilling opportunities arising from receding Arctic sea ice than the greater existential threat the phenomenon of retreating ice represented in itself.

But what about the ‘in your face’ extreme weather events that bring climate change home. When Hurricane Sandy hit at the end of October 2012, for a time climate skeptics were put on the back foot (even though scientists are loathe to attribute any one weather event to climate change). Mayor Michael Bloomberg actually cited Hurricane Sandy and climate change as a catalyst for him supporting Obama in the presidential election (here).

But weather is a fickle friend for those occupying the ramparts and calling for action over climate change, with, for example, this year’s hurricane season proving a spectacular bust; indeed, Bloomberg reports that there have been no Atlantic hurricanes reported as of 4 September. There is a while yet until the end of the hurricane season, but in reality the probability of a few Katrina or Sandy-type hurricanes hitting in quick succession—something that would make an impact on the broader populations adaptive manner of forming expectations—is low.

The same applies to deluge and drought. Both the U.K. and U.S. continue to experience ‘weird weather’. But the record droughts have broken and record floods have receded, and life has moved on. For example, last year the U.S. was gripped with severe drought and this year is still bad—but not quite so bad (click for larger image, chart source here):

Ironically, the resource depletion debate has also followed a similar trajectory. The media has grown bored and skeptics have declared victory. As is typical with such controversies, much of the sturm und drang centres around establishing a straw man in the opposing camp to attack. God forbid we go back to the original sources and read what the influential peak oil theorists of the modern era actually said. For example, here is a high profile article written by Colin Campbell and Jean H. Laherrere back in March 1998 for Scientific American. This is what they said:

The world is not running out of oil – at least not yet. What our society does face, and soon, is the end of the abundant and cheap oil on which all industrial nations depend.

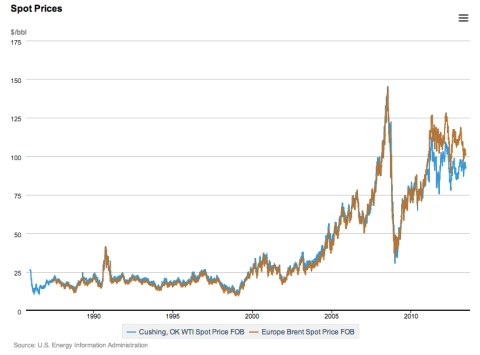

And what was the price of oil when they wrote this article? The annual average cost of crude in the U.S. in 1998 was $11 barrel (see the EIA numbers here). In short, Campbell and Laherrere came out with a big, bold call on rising oil prices in March 1998, and they were absolutely right.

Moreover, from the graph above it is difficult to detect any softening of the oil price in recent years. Not to worry, the media tells us that peak oil is dead, slayed by the white knight of fracking technology. And Daniel Yergin, the high-profile cornucopian who appears to have free rein to write op-ed articles in the Wall Street Journal at will, dances on its dead body. But who has been closer to the truth over the last two decades, Campbell and Laherrere or Yergin? Well here are Yergin’s predictions (taken from a great post at Stuart Staniford’s Early Warning blog):

Ironically, the only time he was bullish on the oil price was just prior to when the global economy plummeted into the Great Recession (in respect of which high oil prices played no small part). Nonetheless, while the upward trend in oil prices remain intact, we are not currently breaking to new records. At the same time, economic actors are doing just enough in terms of substitution and efficiency that the pain is tolerable. That is, until oil prices break substantially higher some time in the future, so tipping us into a new recession.

For those individuals and organisations that call for a proactive and forward-looking response to global warming and resource depletion, the tendency for humans to stick to their existing life narratives unless violently bashed over the head has proved a challenge, particularly in a period of hiatus. Here is a part of Transition Network‘s mission statement:

Transition Network supports community-led responses to climate change and shrinking supplies of cheap energy, building resilience and happiness.

But if most of your audience doesn’t believe that climate change or energy availability is changing sufficiently to impact their lives, then they won’t be receptive to making their lives more sustainable and resilient (and in the process help ensure their children and grandchildren don’t come to live on a planet that has radically changed).

I feel the frustration. A few years ago, I could engage with the agnostic over climate change (the fundamentalist climate skeptics have always been a lost cause). But now most don’t want to know. The Great Recession coupled with the hiatus have led people to return to their comfortable old life narratives.

So what is to be done? I think the way is twofold. First, work with the believers in enhancing sustainability and resilience wherever possible.

Second, and perhaps more controversially, use the off-grid movement as a Trojan Horse to advance sustainability and resilience. Ironically, technology and the information revolution have brought aspects of off-grid living to ever larger segments of the population. And the appeal of the off-grid way of life runs across the political spectrum to encompass a multitude of ways of thinking including:

- Environmentalism

- Post-consumerism

- Down-sizing

- Survivalism

- Libertarianism

Over the summer break, I read two books by Nick Rosen, “How to Live Off-Grid” and “Off the Grid” (the former concentrating on the U.K. experience, the latter the U.S.). Rosen is a lukewarm environmentalist. His motive for moving off-grid is more philosophical:

Some of the cosiest-sounding places in the world are off-grid. And I detected that as well as this physical sense of off-grid, there also seemed to be another meaning – an off-grid attitude that you could take into the local park or your own back yard, a sense of feeling at ease in the world. of reclaiming your independence and individuality. A practical, freewheeling kind of self-sufficiency.

To me, off-grid is synonymous with empowerment. Surprisingly, although technology had created a system of global hyper-capitalism that extols specialisation, supply chain management, outsourcing and the rest, it could allow us to disengage and then deal with the market in our own terms. If you don’t have to worry about the bottom segments of Maslow’s hierarchy of needs (the physiological needs of food, water, temperature control and so on), then you have a better chance to flourish in the higher segments. I will return to this theme in the future.

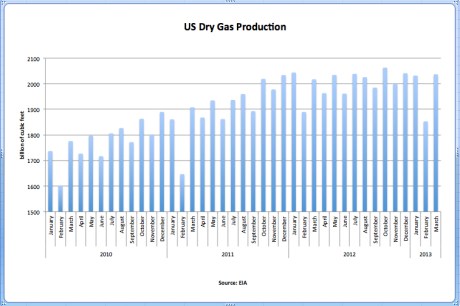

Much recent media attention has centred on a so-called shale-gas revolution in the United States and, in particular, the ability of shale gas to boost overall volume of natural gas production. Many claims are made with respect to the prospective expansion in shale gas production in the coming years including the following:

Much recent media attention has centred on a so-called shale-gas revolution in the United States and, in particular, the ability of shale gas to boost overall volume of natural gas production. Many claims are made with respect to the prospective expansion in shale gas production in the coming years including the following: