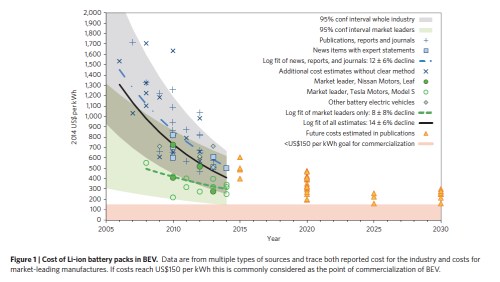

With impeccable timing (for my current blogging theme), Nature Climate Change has just published a commentary by Bjorn Nkyvist and Mans Nilsson reviewing the falling cost of battery packs for electric vehicles (source: here, but apologies as the article is behind a paywall). Bottom line: costs have been falling faster than predicted a few years ago (click for larger image).

In line with Tony Seba’s estimates I blogged on two days ago (here), Nykvist and Nilsson saw total battery pack costs fall 14% per annum between 2007 and 2014 from $1,000 per kilowatt-hour (kWh) to $410. The market leaders in terms of auto battery technology, Tesla and Nissan, saw a slightly lower rate of decline of 6 to 9% since they have been at the cutting edge of improvements and have had less potential for catch-up than the industry as a whole. However, their costs per kWh are now seen at around $300 per kWh of battery capacity. Note that a BMW i3 has battery capacity of approximately 19 kWh, a Nissan Leaf 24 kWh and a top of the range Tesla 85 kWh.

Critical to the Nature commentary is the fact that current battery pack costs are lower than previously predicted by the International Energy Agency, World Energy Council and other observers.

Meanwhile, the authors don’t see any near-term breakthrough in battery chemistry, so further cost falls will be the result of “cell manufacturing improvements, learning rates for pack integration and capturing increasing economies of scale”. All these efficiencies are modelled together as the so called learning rate: the cost reduction following a doubling of production through learning by manufacturing experience.

Going forward, the authors see the learning rate staying at around 6-9 % per annum. Moreover, given that electric vehicle battery production has been doubling every year globally, this learning rate roughly translates into the actual fall in battery pack costs per year. If production volumes continue to expand exponentially (a big ‘if’), the rate of cost decline would see battery pack costs hitting $250 per kWh in 2017/18 and $150 in around 2022. Note that $150 is the level at which the US Department of Energy estimates that electric vehicles will go mass market.

Nonetheless, this tipping point will greatly depend on the price of gasoline and the degree to which batteries can be shrunk. The comparison of electric vehicles (EVs) with internal combustion engine (ICE) orientates around the trade-off between power and energy. For EVs, the limiting factor is energy, not power; for ICE vehicles, it is the reverse. When you buy a top of the line traditional car, you are in effect buying power as well as comfort. A Tesla, by contrast, is as much about buying energy in the form of driving range. As the price of oil comes down, EVs have to work harder to overcome their energy storage disadvantage.

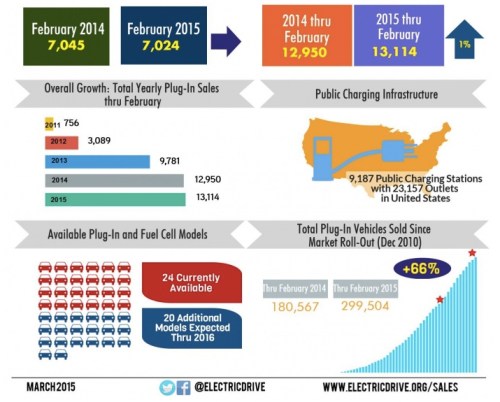

Putting range anxiety issues to one side, McKinsey estimated that at a gasoline price of $6 per gallon, a $400 per kWh EV would start to become competitive with a traditional ICE vehicle. At $3-$4.5 per gallon, EVs need to get battery pack costs down below $250. The US Energy Information Administration reports that gasoline prices average $2.5 per gallon across the United States this March (here). Not surprisingly, this relentless decline in fuel prices, coupled with continued disadvantage of EVs in terms of range and price has been a stiff headwind for EV sales. The Electric Drive Transport Association sees EV sales flat-lining year-on-year in recent months (click for larger image; source: here).

The above analysis puts us at an interesting inflection point. To use learning rate dynamics to get down the battery pack cost curve and go mass market, EV sales need to keep doubling every year. Yet for sales to double every year, battery pack prices need to fall fast to compensate for the declining price of gasoline.

In purely economic terms, it would appear that the EV industry can’t resolve this conundrum and therefore is driving straight into a brick wall. However, there are two possible escape routes. First, governments may provide sufficient subsidies to get the industry down toward its competitiveness tipping point. The benefits secured by such a strategy include air quality improvement, climate change mitigation and first mover industry advantage. As regards the latter, the first maker to get a battery pack price down to $150 has the potential to transform the auto market much as Henry Ford’s Model T production line techniques did a century ago.

Indeed, in a winner-takes-all global economy dominated by giants like Apple, Google and Amazon (which have relentlessly used scale to hammer down their costs) the private sector may relish such a massive investment bet. Tesla’s Gigafactory, with its planned annual capacity of 500,000 battery packs, appears to be an example of just such a wager.

On the other hand, auto sales in the US totalled 16 million in 2014, so for EVs to take 10% market share implies a 16-fold increase in sales. Welcome to the world of the chicken and the egg. If the industry could get production up 16-fold it would get costs down sufficiently to stimulate enough demand to get production up 16-fold. Now how do we get from here to there?

This is an astute and well-written post R Pessimist, so congrat’s and well-done.

As a Tesla shareholder I found this extremely interesting and informative. Thanks!

I agree that the article is very pragmatic. As a holder of Oil company stocks, I would like to see a reply to this fine article from the ICE camp. Regards.