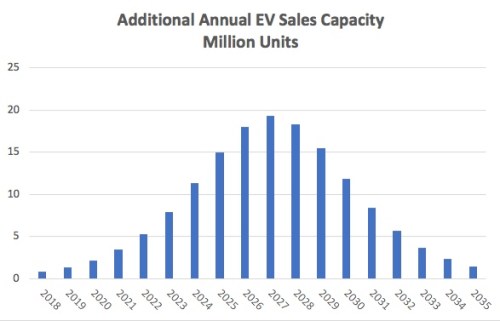

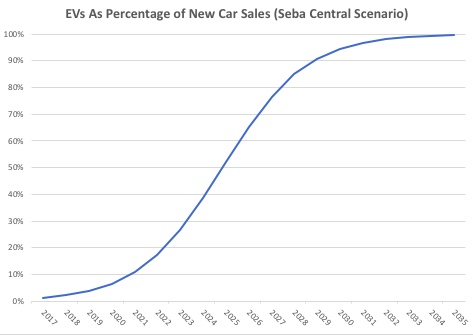

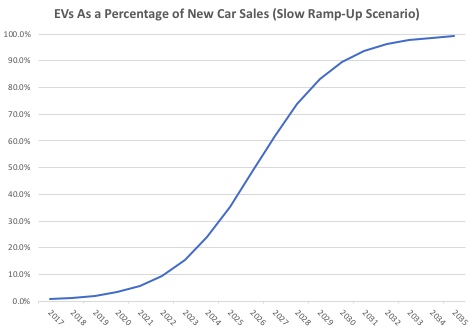

Let’s have a recap of where we need to be on Tony Seba’s S curve in 5 years’ time. For starters, out comes this chart again:

From my last post, we saw that China’s State Council is targeting 2 million EV sales by 2020, and through the use of a series of central-, provincial- and city-government level carrots and sticks should get there with ease.

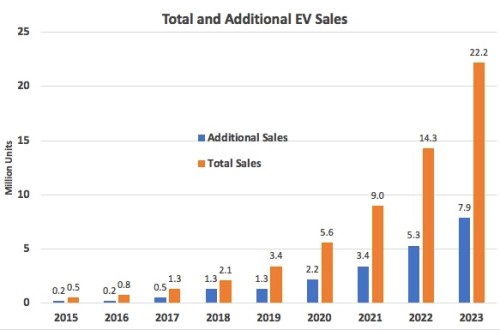

On Tony’s S curve, we need to register 5.6 million global EV sales to keep on track for 130 million sales by 2030; that is the logic of an S curve. This is where we stood in 2017:

So if China is doing 2 million EVs in 2020, we need to find 3.6 million EV sales from the rest of the world. Given we are estimated to hit 800,000 EV sales outside China in 2018, a jump to 3.6 million in 2020 is a more than three fold increase.

But we should remember that we are at the very foothills of the S curve. If we go out a bit further to 2023, we need to see global EV sales of 22.2 million units to keep Tony’s dream alive. Now while the Chinese state has gone full Tony, we have limited evidence that it’s citizens are all completely on board with the programme.

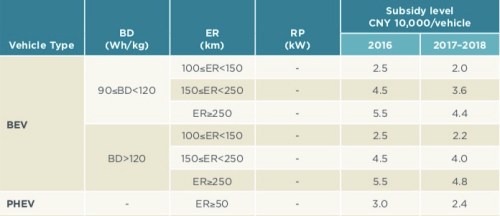

Currently, there is a high degree of force feeding of EVs going on via state-owned enterprise procurement, the EV subsidy system and city level non-EV car registration caps. Moreover, next year the “New Energy Vehicle (NEV)” 10% incentive scheme will, in effect, force all auto makers down the EV route.

Indeed, China, as an authoritarian state, could just ban internal combustion engine (ICE) vehicle sales just as many other countries have promised to do. The following table from Wikipedia shows the expressed intentions of a swathe of states and cities to ban ICE vehicles.

Such actions, however, will not in and of themselves get us to an EV sales penetration rate of 95% by 2030, since there are a host of countries, most obviously the United States, whose political systems are not very good at pushing their citizens to do things they don’t want to do.

Nonetheless, if the Chinese consumer chooses voluntarily to buy an EV over an ICE car– rather than be forced to buy and EV over an ICE car–then this will be a far better catalyst for the wholesale global adoption of EVs. So the question then is whether Chinese auto makers can make cars that Chinese consumers want without subsidies, NEV credits, city ICE bans or whatever.

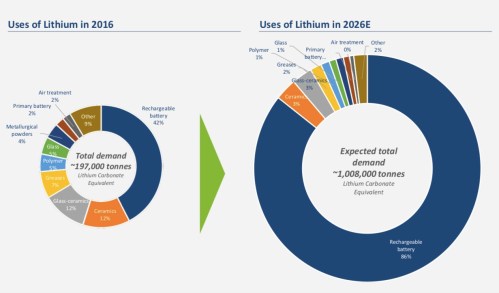

For me, the wake-up call that Chinese manufacturers were actually far further along the road toward making attractive and desirable EVs came to me, strangely, while watching a presentation by the CEO of the lithium mining company Pilbara Minerals (ticker PLS listed on the Australian Stock Exchange). in April 2018, Pilbara Minerals CEO Ken Brinsden got a coveted spot to present at the prestigious (in resource circles) Melbourne Mining Club.

The beginning of the video consists of Ken being very smug about the fact that Aussie miners can now rebrand themselves as eco warriors rather than rapists of the planet. From 11:45 into the presentation, however, Ken switches to talking about China. Given that he has been negotiating and partnering with the Chinese battery material makers for some years now, he has a unique insight into what is going on there.

The presentation slides are available here:

Ken Brinsden, MD & Chief Executive Officer, Pilbara Minerals

His general overview of how fast China is moving in EVs is something I am familiar with, but 21 minutes into the presentation I got rather a shock when Ken started to talk about a particular car: the luxury SUV called the Wey made by Great Wall Motors. Now I had vaguely heard of Great Wall, but I was completely unaware that a domestic Chinese manufacturer was capable of making a prestigious EV SUV that in time will compete directly with Tesla’s Model X. In Ken’s words:

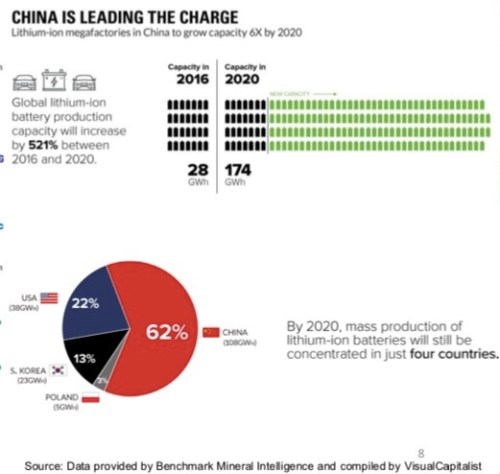

“For those of you who have a picture in your mind that the Chinese cannot build a quality outcome, I’m telling you they are already there. And as a result, they are in a very short period of time going to become the dominant global car supplier because they have got the technology right, they’ve locked up the lithium-ion supply chain, and especially the raw materials, and they are also producing the quality product.”

I would echo Ken’s remarks about looking down on the ability of any developing Asian nation to go up the value chain. I am old enough to remember as a child Japanese cars being termed “Jap crap”, just as the UK car industry was going into terminal decline. Then in the 1980s and 1990s while working in Japan I took countless meetings with senior Japanese executives who had a similar attitude towards Korean products. Panasonic telling me that Samsung products were crap, Toyota same with Hyundai, and then Nippon Steel with POSCO. Then in the 2000s, I had a ringside seat as China’s Baoshan Iron and Steel made its meteoric rise both in terms of tonnes of steel produced and the quality of the products.

The brand CEO for the Wey is Jens Streingrabber, who was responsible for SUV development at Audi, and the chief designer of the Wey hales from BMW. So build quality is something Great Wall understands. True, the first low-end Great Wall cars that have arrived upon European shores have got poor reviews (for example see here), but I would not take that as indicative of where they will remain on the quality ladder. Great Wall’s aspirations are evidenced by initiatives to incorporate Level 5 autonomous driving capability and contactless charging in future Wey models. You can see a pure high-end Wey X EV at the April 2018 Beijing motor show here.

True, the Wey X on display at Beijing was a concept car, but full production versions of EV versions of Wey SUVs and Great Wall’s new pure EV brand ORA are on their way. And these are just part of a wave of EV disruption that is set to come out of China. I’ll spend one more post looking at the Chinese EV auto maker ecosystem across all the major makers, and the potential for Chinese EV makers to act as the mega disruptors, then it will be time to talk about Tesla.

For those of you coming to this series of posts midway, here is a link to the beginning of the series.

\

\